A single connection to the global KYC/AML and fraud ecosystem

FrankieOne provides a single connection into the global ecosystem of KYC, KYB, AML & fraud tools, helping banks and FinTech's 'switch on' the best-of-breed solutions.

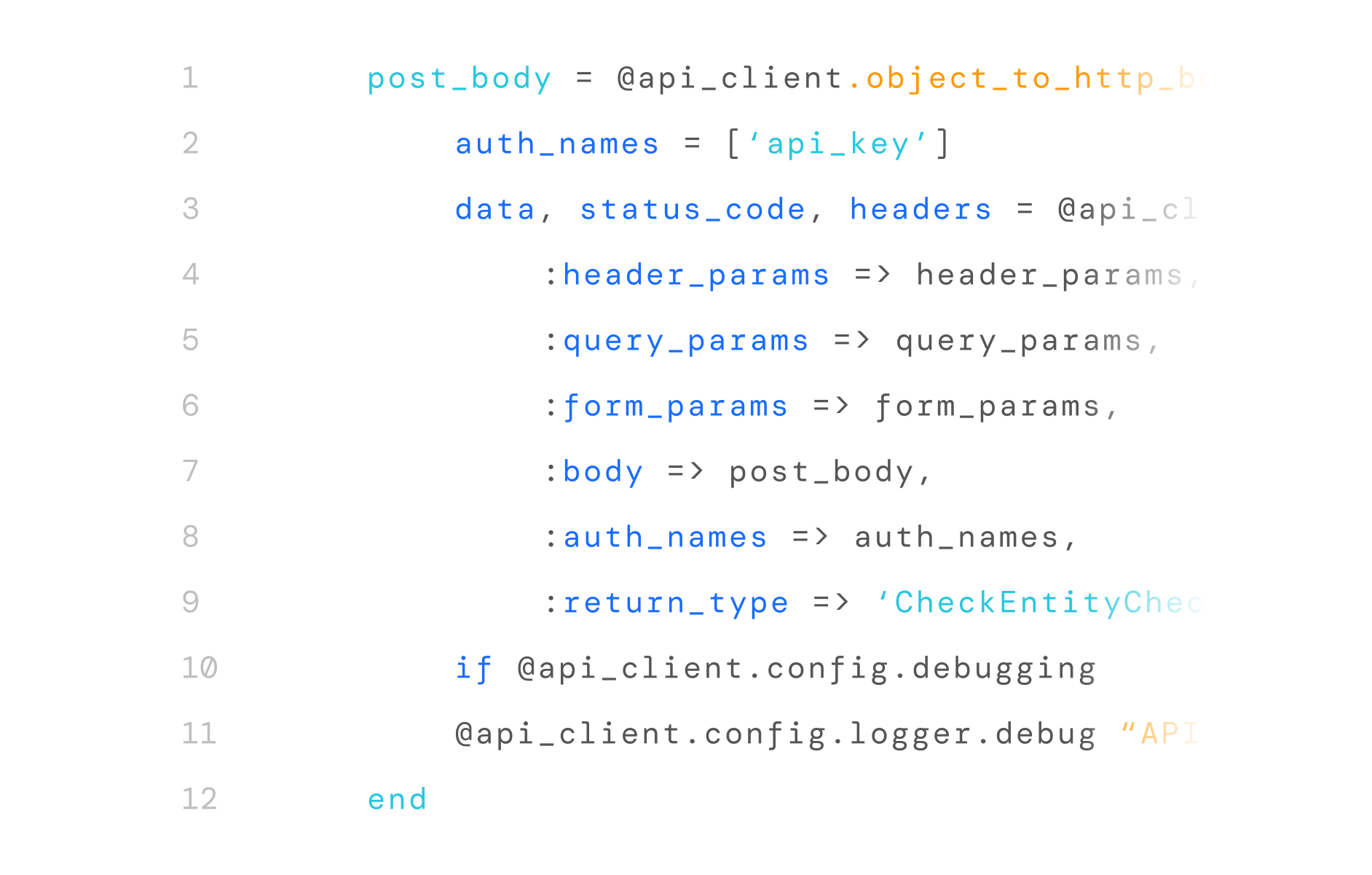

API Integration Hub

Customizable Decision Engine

Single Customer View

Trusted by the world’s top banks, fintechs & financial services companies

Customer acquisition

Increase pass rates, reduce fraud

Choose from a universe of checks and switch on the ones you need

Orchestrate end-to-end customer onboarding by simply 'switching on' new vendors, data sources, checks & verifications. Rapidly activate new capabilities & stay ahead of your evolving business needs.

Signals are fed into the real-time, risk-based decision engine

Define custom risk profiles for your customers and automate decisioning for individuals and businesses through fully configurable dynamic workflows.

Enable a dynamic, risk-based customer journey end-to-end

Dynamically adjust verifications and checks based on the real-time risk rating of individuals. Protect yourself during onboarding, and ongoing against fraud and bad actors with sophisticated real-time risk ratings.

Single integration

Easily connect to a global ecosystem of fraud and identity tools

Our unified API integrates hundreds of the best of breed global vendors and data sources. Configure and ‘switch on’ solutions in real-time with little to no development work.

Implement on mobile and desktop with a few lines of code, leverage our customized front end, fraud solutions, biometrics solutions, headless solutions and more.

Featured in

Data Security and Privacy is at the heart of everything we do

We are committed to protecting our customers' data, adhering to the highest security and privacy standards. Our customers include highly regulated financial institutions like Tier 1 banks, who trust us with their onboarding and ongoing monitoring processes.

.png?width=235&height=56&name=Untitled%20design%20(7).png)

.png?width=260&height=62&name=Untitled%20design%20(11).png)

.png?width=210&height=50&name=Untitled%20design%20(9).png)

.png?width=250&height=60&name=Untitled%20design%20(10).png)